A shrinking proportion of Varma’s investments are in companies that are dependent on fossil energy sources and in corporate bonds that invest in them. This was also found in a WWF report that assesses global pension funds’ commitment to climate targets.

“We don't want to be involved in financing climate change. Our key target has been to reduce carbon dioxide emissions, because when it comes to climate change, coal has the most harmful effects,” says Varma’s Director of Responsible Investment, Hanna Kaskela.

In terms of coal, Varma was in aligned with the climate targets of the Paris Agreement, the report indicates. Varma's holdings in oil stock are negligible, and the company excludes all coal-mining companies from its investment universe.

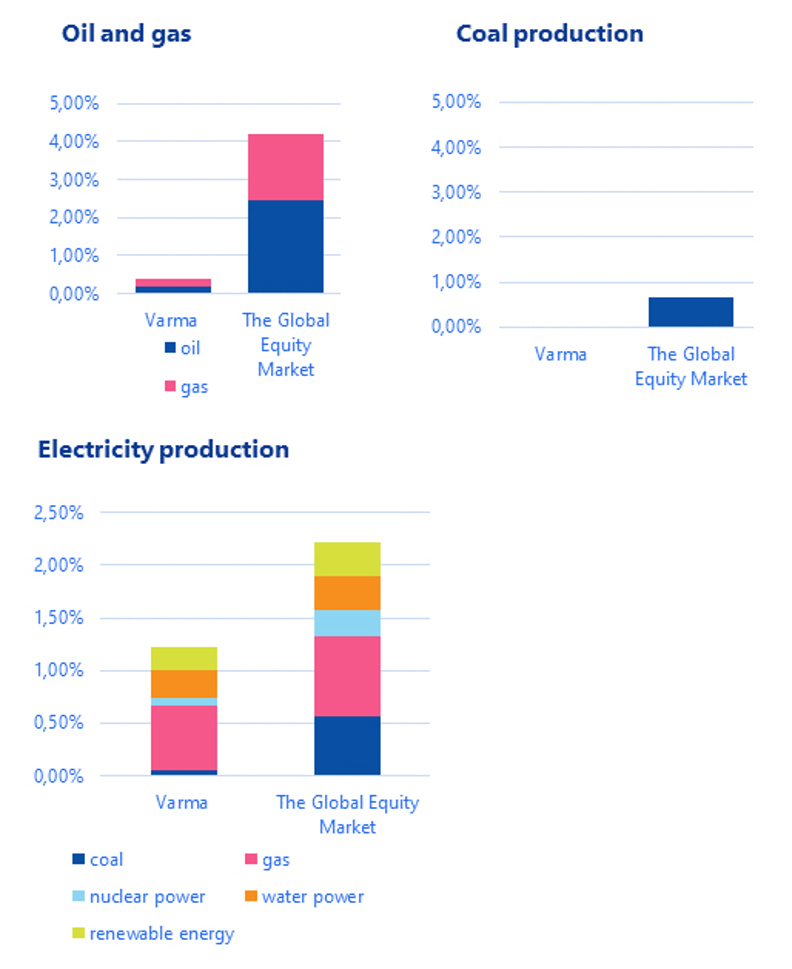

The share of emission-generating fossil-fuel production in Varma’s investments in listed companies accounted for 0.39 per cent of the total market value and in corporate bonds for 0.3 per cent. The corresponding figure for the global equity market was 4.84 per cent and in bonds 4.2 per cent, according to the WWF study.

The assessment covered investments in listed companies and bonds. The WWF covered companies’ holdings in these asset classes at the end of 2017 in relation to the IEA’s 1.75°C warming scenario. The report included investments in renewable energy forms, coal mining and oil production, as well as in companies that are dependent on coal and gas.

According to Kaskela, assessing the risks of climate change has become a part of everyday risk management for investors.

“It is increasingly difficult for operators who rely on fossil energy sources to find investors who believe in their future, especially if the companies have no plan for reducing their emissions. If a company ignores climate risks, we believe the risks will materialise in the future in the form of poor investment returns,” Kaskela stresses.

The shares of fossil fuels in Varma’s investments in listed companies

Source: The 2° Investing Initiative

Investors want more low-carbon options

The WWF report states that much greater efforts are needed on behalf of all investors in order to reach the IEA’s 1.75°C scenario in all sectors. The Intergovernmental Panel on Climate Change (IPCC) believes that the increase in global warming should be limited at an even faster rate, to 1.5°C by 2030.

“This mission is extremely challenging. Varma’s portfolio managers have worked hard to bring our direct equity investments in line with the targets of the Paris Agreement. When we can choose the equities ourselves, we have better control over climate matters. When it comes to mitigating climate change, it would also be important for global index investors to shift their focus towards lower-carbon investments,” states Kaskela.

The limited options, especially in listed companies, are making investments in renewable energy more difficult.

Nordic companies show the way in climate matters

In recent years, Nordic investors have been at the forefront of contributing to climate-friendliness and reducing the carbon footprint of their investments. In the AODP’s ranking of the world’s 100 largest public pension funds on their responses to climate change, Varma had the best ranking among Finnish companies, placing 5th. The AODP’s report, however, revealed that more than 60 per cent of pension funds have little or no approach to climate change.

According to the WWF report, Nordic companies also have the greatest willingness to disclose the climate impacts of their investments.

WWF invited 88 companies from 11 countries to take part in the comparison, and ultimately 33 asset owners disclosed their findings.

“We want to be open and we also want to know as much as we possibly can about the climate impacts of our portfolio. New tools for assessing the impacts of climate change are constantly being introduced, and nowadays even independent parties are conducting comparisons. This is a positive development,” concludes Kaskela.