The start-up grant is intended to support the livelihood of a new entrepreneur. However, it is not automatically granted to just anyone, but is discretionary. For example, in cases where an entrepreneur can immediately earn a sufficient income from his or her business, the start-up grant will not be granted. When applying for a start-up grant, the business plan of the future enterprise and its ability to operate profitably on a continuous basis will also be assessed.

However, a future entrepreneur does not need to have all the answers ready. The applicant can also seek advice from the TE Office and the Enterprise Finland service.

The amount of the start-up grant is equal to the basic unemployment allowance

The start-up grant is granted by the TE Office and paid by the KEHA Centre. The first positive decision usually covers support for six months. If a new entrepreneur still needs financial support for the period after that, he or she can apply for an extension. In principle, the start-up grant is granted for a maximum of 12 months.

The start-up grant is taxable income. It is equivalent to the basic unemployment allowance of EUR 37.21 per day (in 2024), paid five days a week. If you work 20 days a month, your start-up grant will bring you a gross income of EUR 744.

First a start-up grant, then full-time entrepreneurship

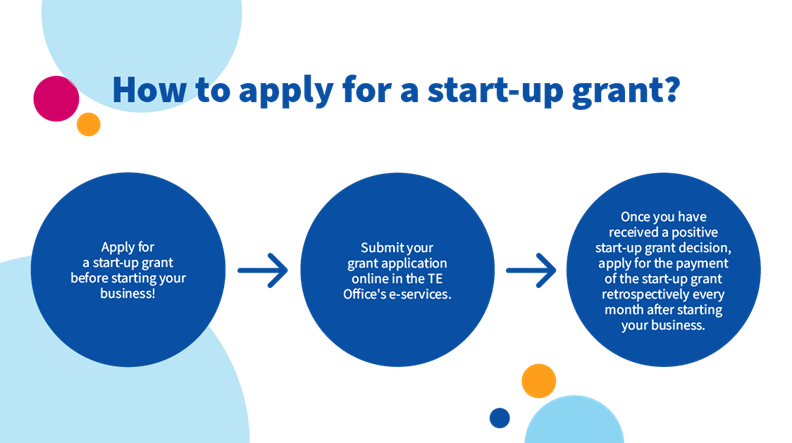

You can apply for a start-up grant electronically in the private customer's E-services of the TE services. In your application, you should describe your future business as clearly as possible. You will need to attach the business and financial plans, and possibly other documents, to your application.

It is essential to apply for a start-up grant before starting business activities – in principle, a start-up grant will not be granted if your full-time business activities have already started before any decision on the grant has been made. The TE Office therefore recommends that you contact the Enterprise Finland Telephone Service when you are planning to start your business and apply for a start-up grant.

Early contact with the TE services is particularly advisable when a person planning to become a full-time entrepreneur already has an existing business. For example, you can apply for a start-up grant if you are an employee who has established a part-time business and wants to become a full-time entrepreneur. However, you need a start-up grant decision before the end of your full-time employment, because otherwise you will usually be considered a full-time entrepreneur. It is therefore a good idea to be prepared to discuss your plans and situation in detail with the TE Office.

Apply for the payment of the start-up grant retrospectively each month

Once you have received a positive decision on your start-up grant application and started your full-time entrepreneurial activities, apply for the payment of the start-up grant in the E-services of the TE services. You can apply for the payment of the start-up grant one month at a time retrospectively.

If you need a start-up grant for a period longer than granted in the first decision, submit an extension application at least one month before the end of the current start-up grant period.

For more information on how to apply for a start-up grant, see the Suomi.fi website.

The purpose of Varma's marketing communications is to promote earnings-related pension insurance and to market Varma's services. We also publish other content that may be relevant or of interest to an insurance policyholder or a person starting a business. This content is general information, and Varma is not responsible for its exhaustiveness. We cannot guarantee the applicability of the content to all situations and are therefore not liable for any damages caused by the use of the information in the published content. Any use of the information in the published content shall be at the user's own risk.