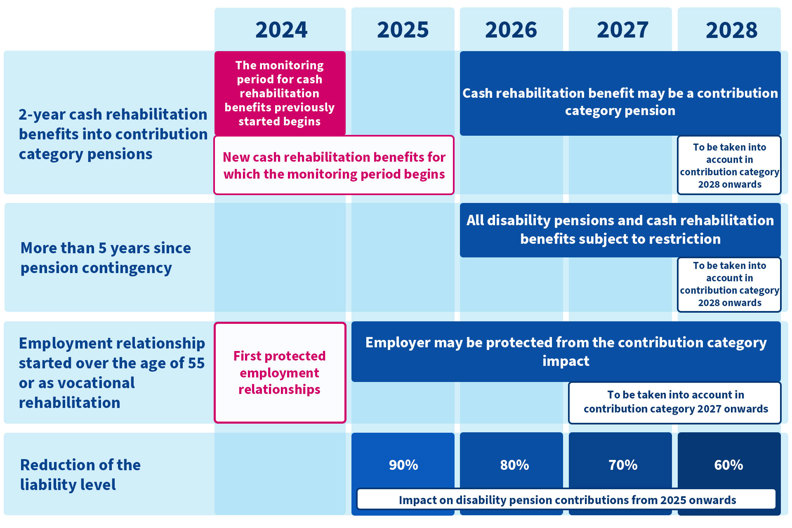

The reform entailed a long transition period, which means the changes will affect employers’ contribution category and TyEL contributions gradually. 2026 could possibly be the most significant year in terms of the reform entering into effect, as prolonged cash rehabilitation benefits will be taken into account for the first time as pensions having an impact on the contribution category. The impacts of cash rehabilitation benefits, however, will only be seen for the first time in the employer’s 2028 contribution category.

The contribution category reform will enter into force gradually between 2024 and 2028

Prolonged cash rehabilitation benefits included in the contribution category model in 2026 – Varma Online Service offers tools for estimating the contribution category

Still in 2025, only permanent disability pensions were taken into account as pensions affecting the contribution category, but as of 2026, prolonged cash rehabilitation benefits are included alongside them.

Cash rehabilitation benefits that started at least two years ago and are still valid at the end of the year are considered pensions that affect the contribution category. In terms of the year 2026, this essentially means cash rehabilitation benefits that began in 2024. In 2026, there will be an exceptionally high number of pensions affecting the contribution category, as cash rehabilitation benefits that began before 2024 will also be taken into account for the first time as affecting the contribution category. However, cases where a person’s disability started (pension contingency) in 2020 or earlier are not taken into account.

The inclusion of cash rehabilitation benefits in the contribution category model does not automatically mean a higher contribution category. The contribution category of an individual employer is determined by comparing the pension expenditure arising from the disability pensions and cash rehabilitation benefits taken into account in its own contribution category with the average level of such pensions. The exceptionally high number of pensions with a contribution category impact in 2026 will also raise the average level.

Even though cash rehabilitation benefits may be taken into account in 2026 as affecting the contribution category, they will only impact the contribution category, and thereby the TyEL contribution, for the first time in 2028. Tools for keeping track of and estimating the development of the contribution category are available to you in the Varma Online Service.

Did a new employee you hired after 1 January 2024 who was over 55 or in vocational rehabilitation become unable to work? Be sure to apply for an exemption from the contribution category in the Varma Online Service

As of 2024, employers have been able to hire a new employee aged over 55 or a vocational rehabilitant with less risk than before. If the newly hired over-55 employee loses their work ability, the employer’s contribution category will not be affected. In the case of an employee undergoing vocational rehabilitation, there is no impact on the contribution category if the rehabilitant’s disability starts (pension contingency) within 5 years from when the rehabilitation measures were started while in the service of the employer.

In order for these situations not to affect the company’s contribution category, the employer must apply for an exemption from the contribution category impact in the Varma Online Service. The employer must apply for an exemption at the latest by November 15th of the year following the year in which the impact on the contribution category applies. For example, if a new employee over the age of 55 was hired in 2024 and retired on a disability pension in 2025, the application for an exemption from the contribution category impact must be submitted no later than 15 November 2026.

The application for an exemption from the contribution category impact can be submitted immediately when the employee is granted a disability pension or the cash rehabilitation benefit. If, for example, a new employee who meets the criteria is granted the cash rehabilitation benefit this year, there is no need to wait for the contribution category impact to take effect before submitting the application.

How to apply for an exemption from the contribution category in the Varma Online Service:

- Log in to the Varma Online Service

- Go to the ‘Work ability’ section on the Decisions page and select “Apply for a contribution category exemption”

- Select the pension of the person for whom you are applying for an exemption

- Fill in the application